- Simplifying Money Transfers!

Money Remittance Software Solution & Development in Dubai, UAE

Leading white-label remittance platform helping businesses in the UAE offer fast and hassle-free international money transfer services.

Leading white-label remittance platform helping businesses in the UAE offer fast and hassle-free international money transfer services.

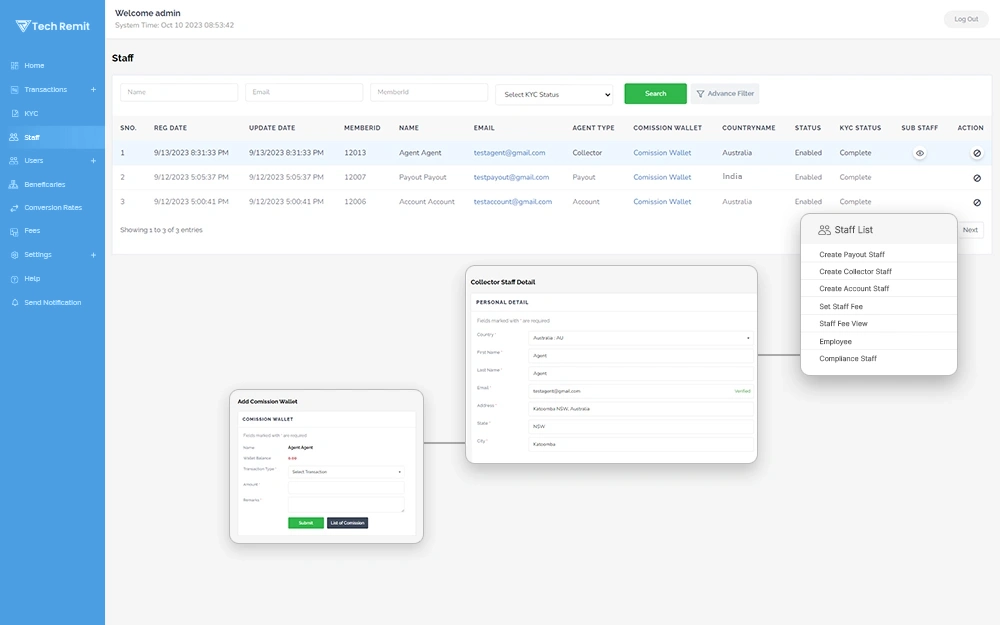

Our remittance software applications cater to licensed money transfer organizations, assisting them in streamlining complex international transfer services and serving global customers. Here are some of the features of our applications that make them useful for any remittance business:

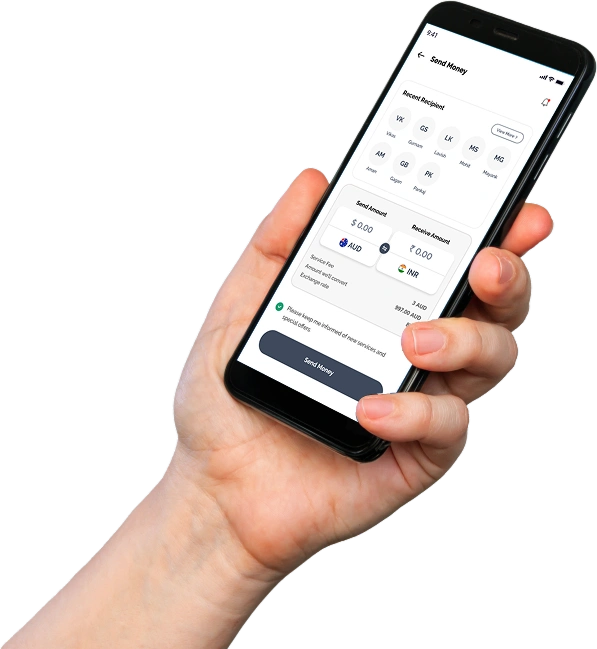

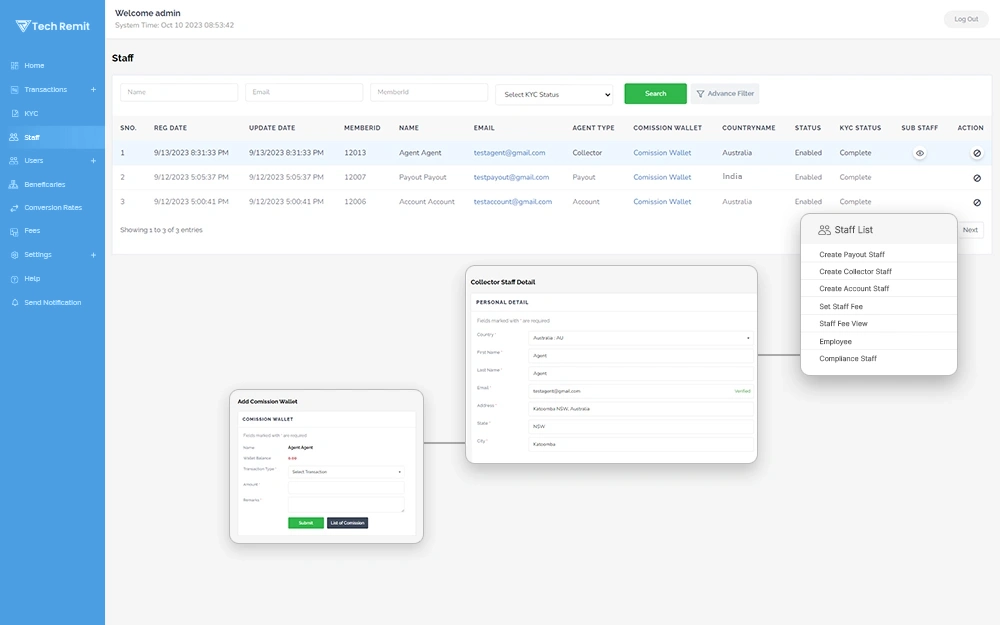

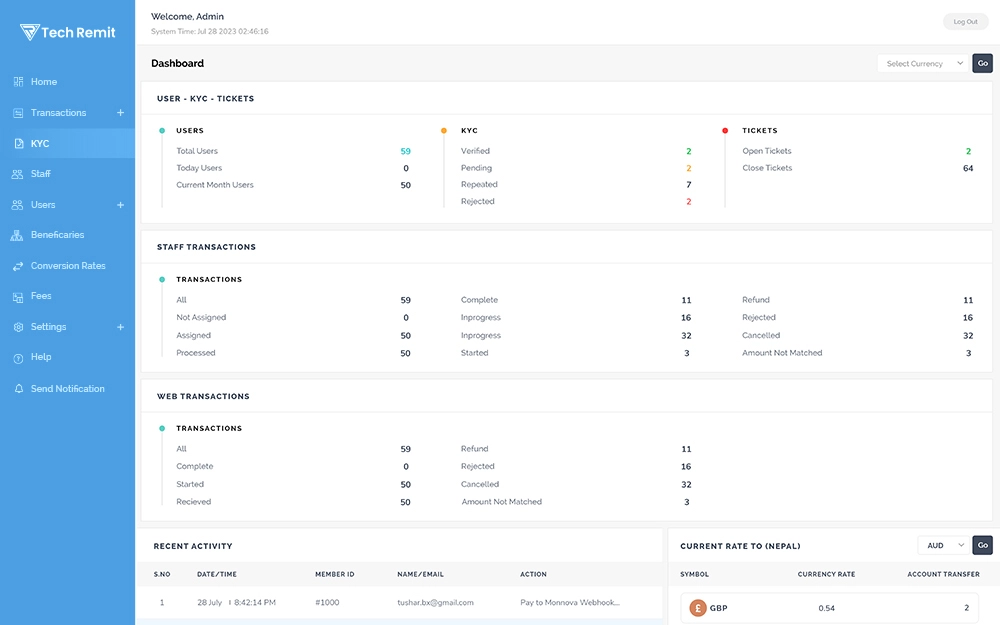

Our remittance platform’s comprehensive analytical dashboard allows businesses to better access and control all of their remittance operations.

The cloud-based framework of our cross-border payment software helps in providing quick and efficient money transfers.

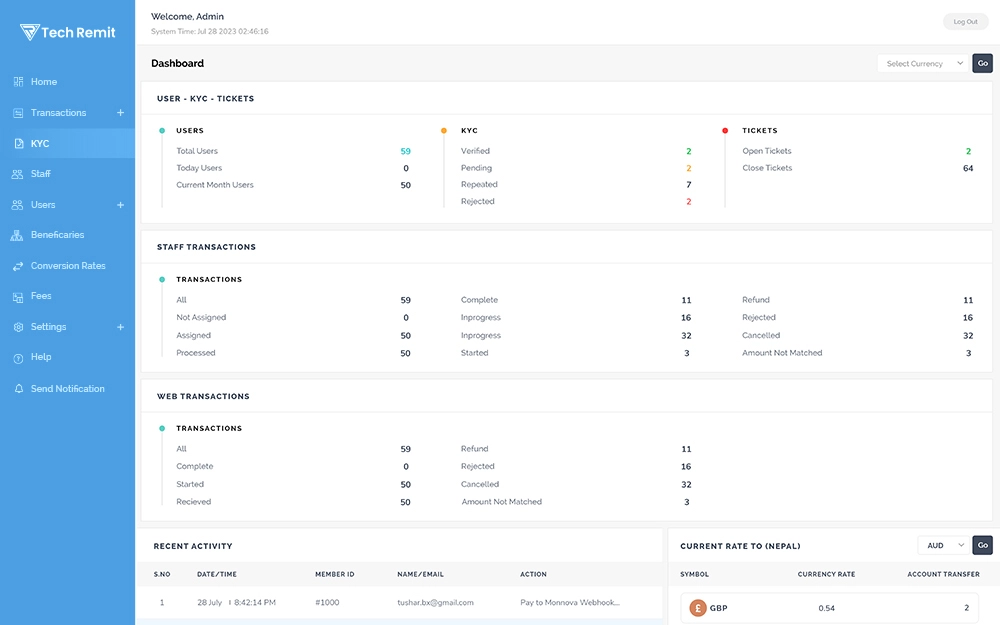

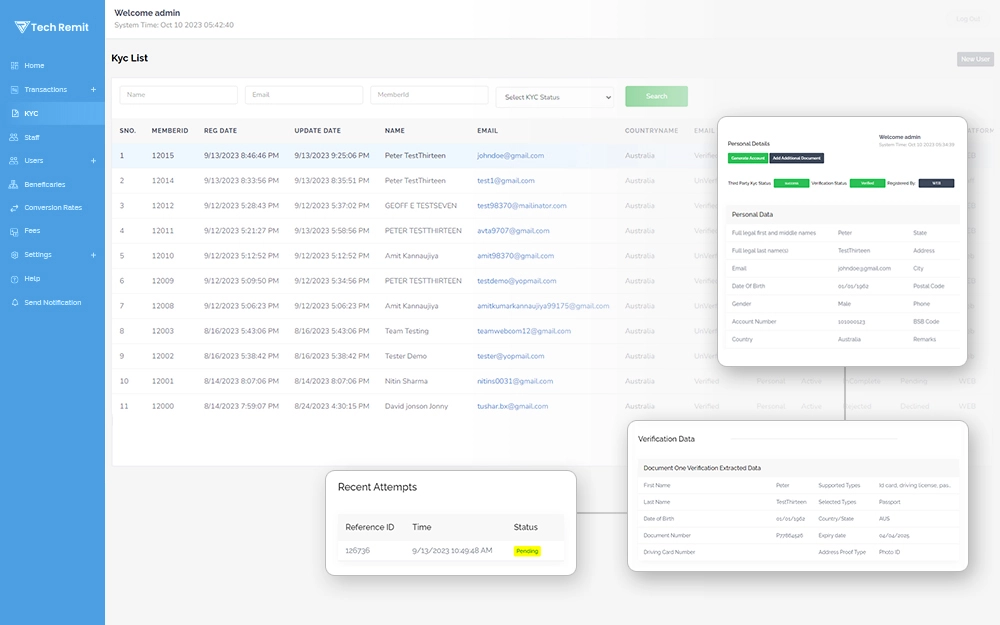

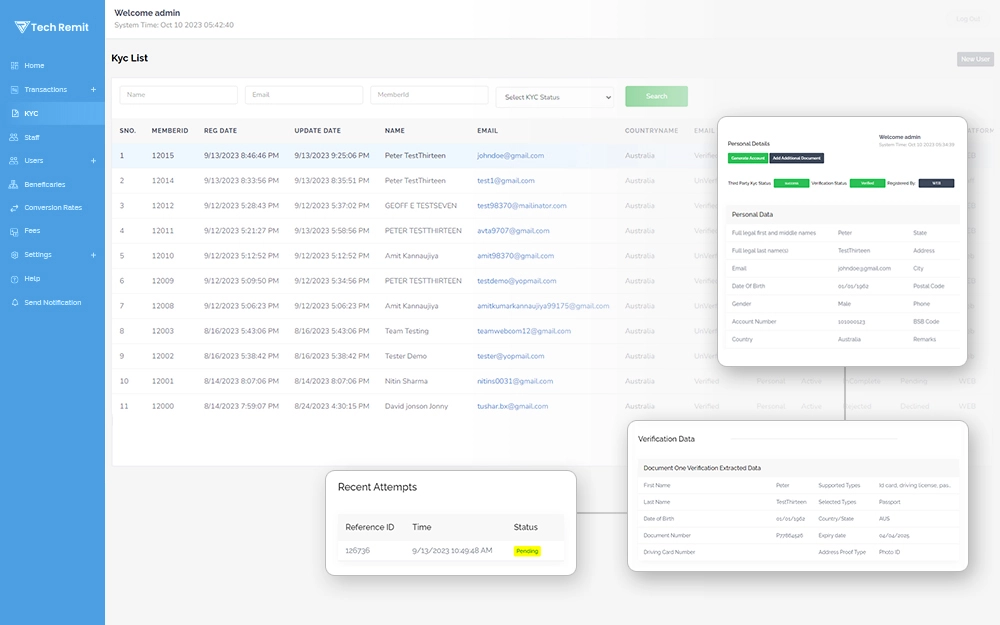

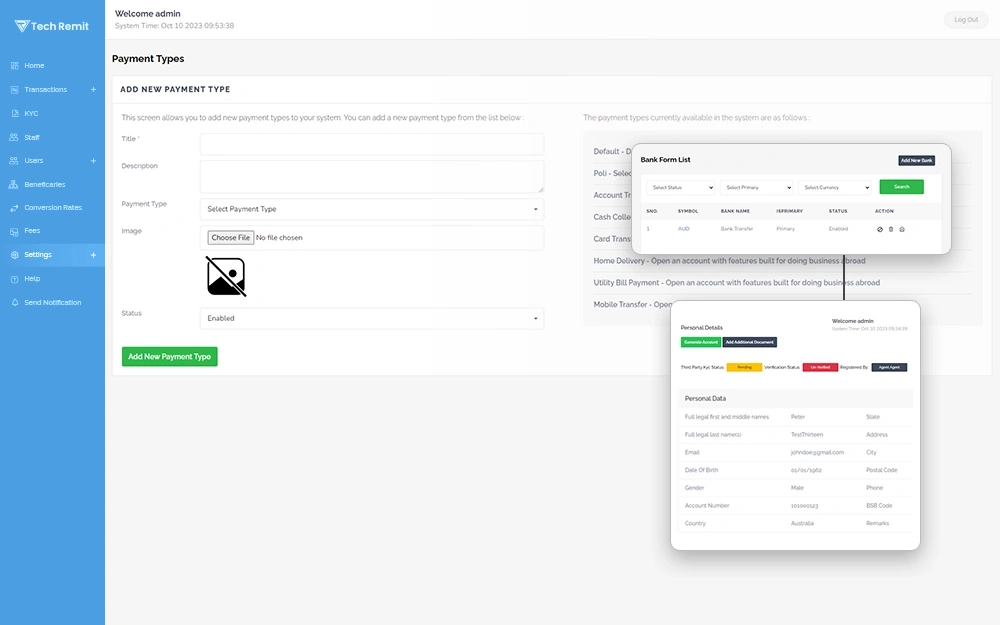

Our remittance platform users can sign up online by fulfilling the simple AML and KYC requirements, without any physical visits or holding excessive paperwork.

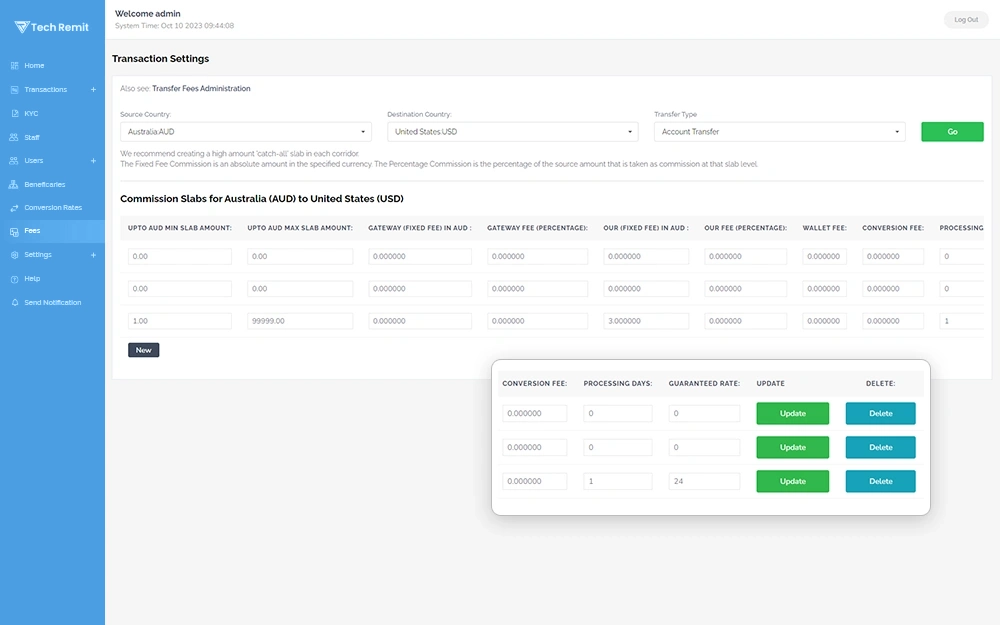

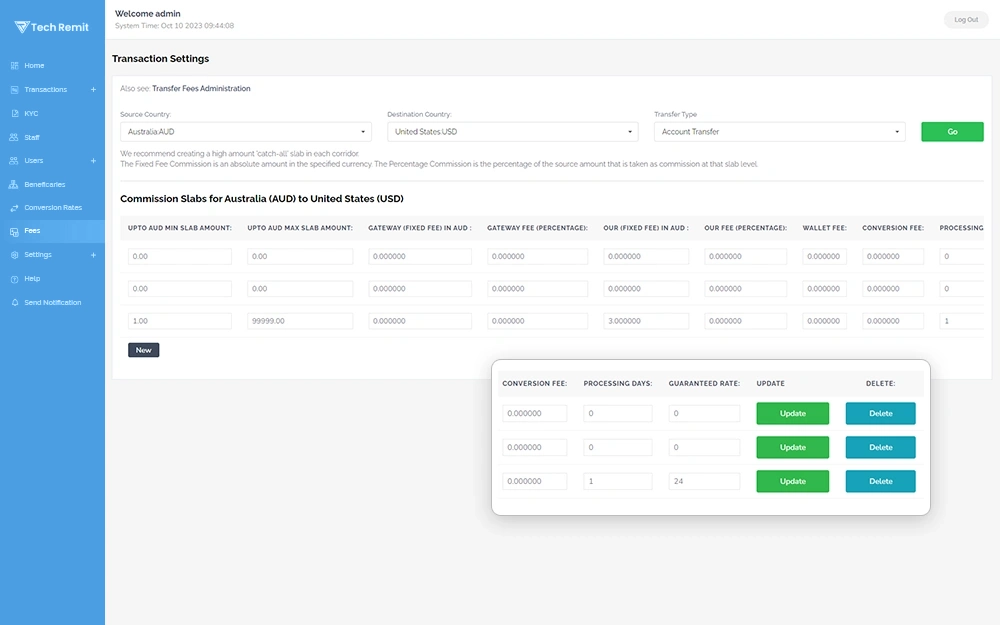

Fitted currency exchange calculators and customizable rate settings in our remittance software allow adjusting exchange rates as well as commissions.

Our delivered remittance solution complies with all the necessary regulations, such as AML and KYC, to carry out legal remittance services between countries.

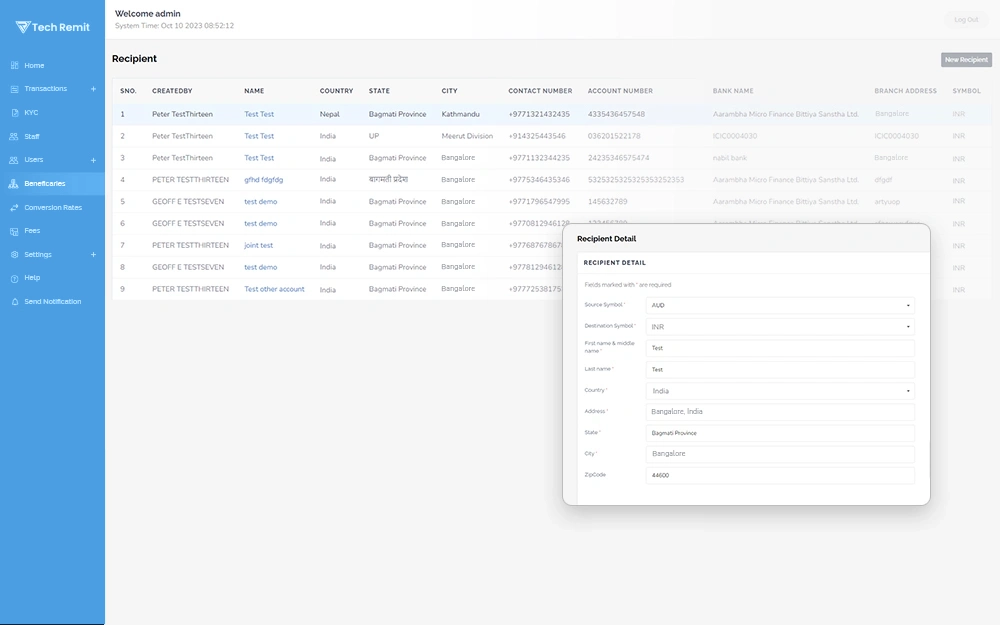

From account setup to transaction tracking and completion, the money transfer software offers simplified remittance and transaction management.

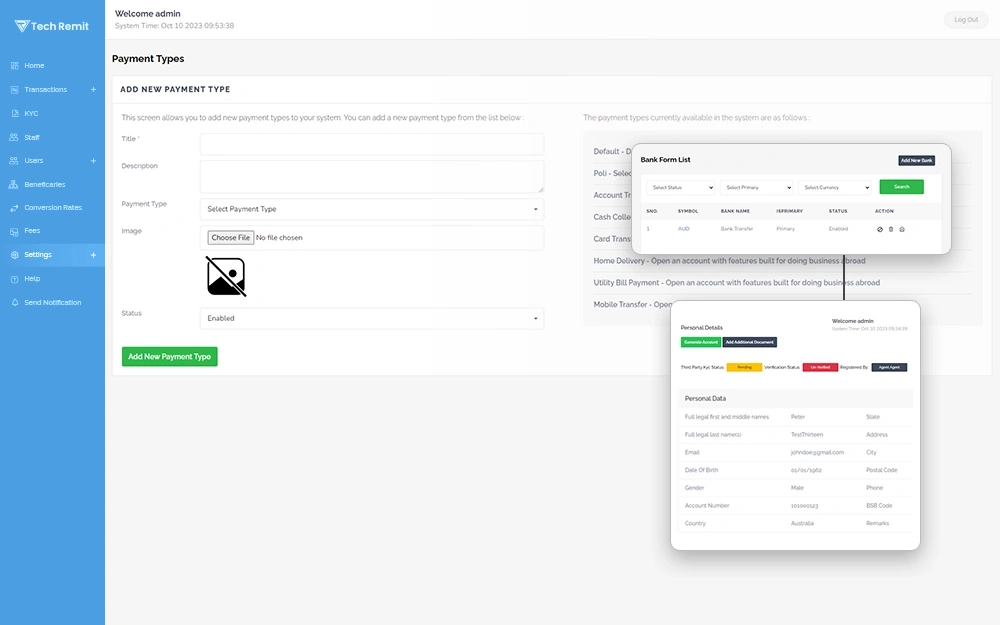

Our platform easily connects with multiple payment methods, including mobile wallets, bank transfers, and card payments, for better flexibility for clients.

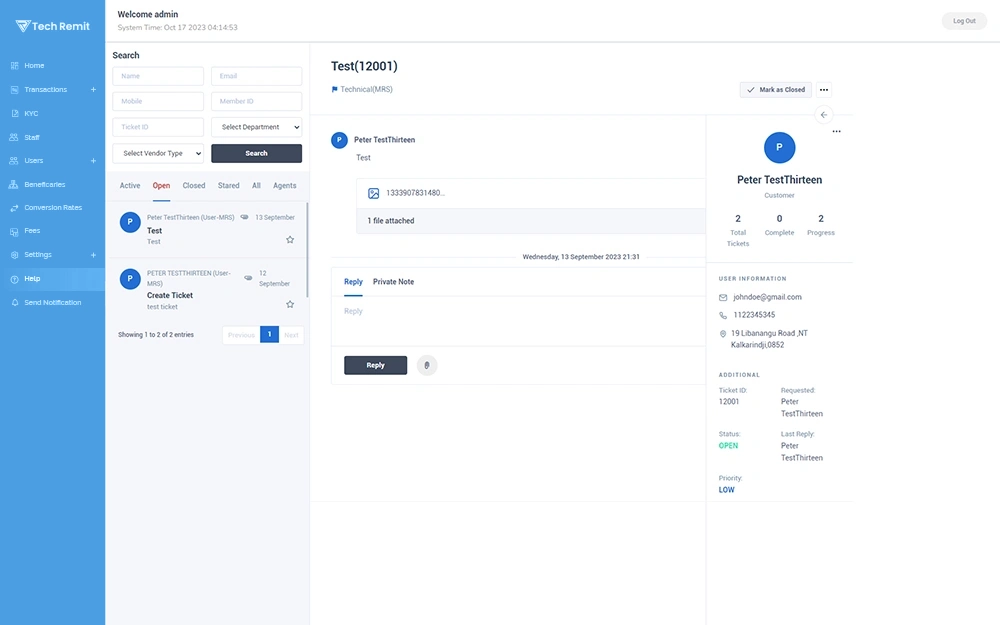

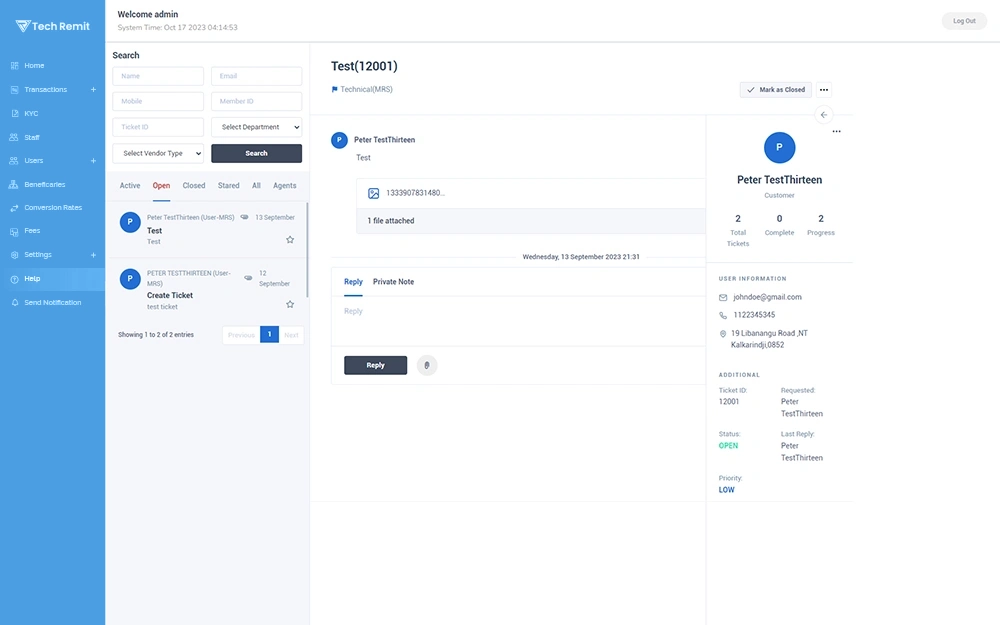

With a comprehensive technical support system via chat and phone, our international payment software can assist clients at any time of the day or week.

Sophisticated data reporting tools in this software generate comprehensive reports and offer full insight into user transactions, activities, and more.

The money remittance sector plays a vital role in supporting immigrant families and sustaining global economies. Moreover, the demand for remittance services has surged in the last few years, encouraging more and more businesses to enter the market. However, managing remittance operations is not easy. It entails numerous complexities and stringent regulations that must be considered. Hence, remittance companies must have strong, compliant, and efficient systems in order to provide their customers with reliable money transfer services.

Prime Web Technologies is a software development company assisting banks, payment providers, and money transmitters with its advanced remittance software solutions. Our white-label remittance platform is equipped with all the right features and technologies to meet the complex demands of modern remittance businesses. This expertly developed remittance software makes it effortless to provide speedy, affordable, and transparent money transfer services worldwide.

Whether you are just starting out or looking to upgrade from your traditional remittance systems, our remittance software is a perfect solution for you. Skip the hassle of building remittance software from scratch and get ready-to-launch remittance infrastructure to enter the market faster.

The money remittance sector plays a vital role in supporting immigrant families and sustaining global economies. Moreover, the demand for remittance services has surged in the last few years, encouraging more and more businesses to enter the market. However, managing remittance operations is not easy. It entails numerous complexities and stringent regulations that must be considered. Hence, remittance companies must have strong, compliant, and efficient systems in order to provide their customers with reliable money transfer services.

Prime Web Technologies is a software development company assisting banks, payment providers, and money transmitters with its advanced remittance software solutions. Our white-label remittance platform is equipped with all the right features and technologies to meet the complex demands of modern remittance businesses. This expertly developed remittance software makes it effortless to provide speedy, affordable, and transparent money transfer services worldwide.

Whether you are just starting out or looking to upgrade from your traditional remittance systems, our remittance software is a perfect solution for you. Skip the hassle of building remittance software from scratch and get ready-to-launch remittance infrastructure to enter the market faster.

Any company looking to provide real value to their remitters and also thrive in the remittance industry must invest in Prime Web Technologies’ money transfer solutions.

No need to wait for months to develop remittance software; our solutions can take you into the market in no time.

Specifically engineered to scale up to meet customer demands as the business grows while ensuring an ideal user experience at all times.

You don't have to purchase special infrastructure, as our cloud-based solution simplifies the management of your remittance services.

We protect remittance businesses from potential risks by following regulatory compliance and incorporating security features into the software infrastructure.

Our developed money transfer engine processes transactions in real-time with instant payment confirmations and also provides detailed delivery updates.

You can run our white-label remittance platform under your brand name to provide a personalized experience for your customers.

We follow the latest safety protocols and compliance regulations to protect our international money transfer systems from any possible threat.

This remittance platform’s intuitive interface and well-structured remittance roadmap make it much easier for your customers to use.

A user can quickly register for an account on the platform after completing the required KYC verification process.

To initiate a transfer request on the platform, the user needs to choose the currency, delivery method, and transfer amount.

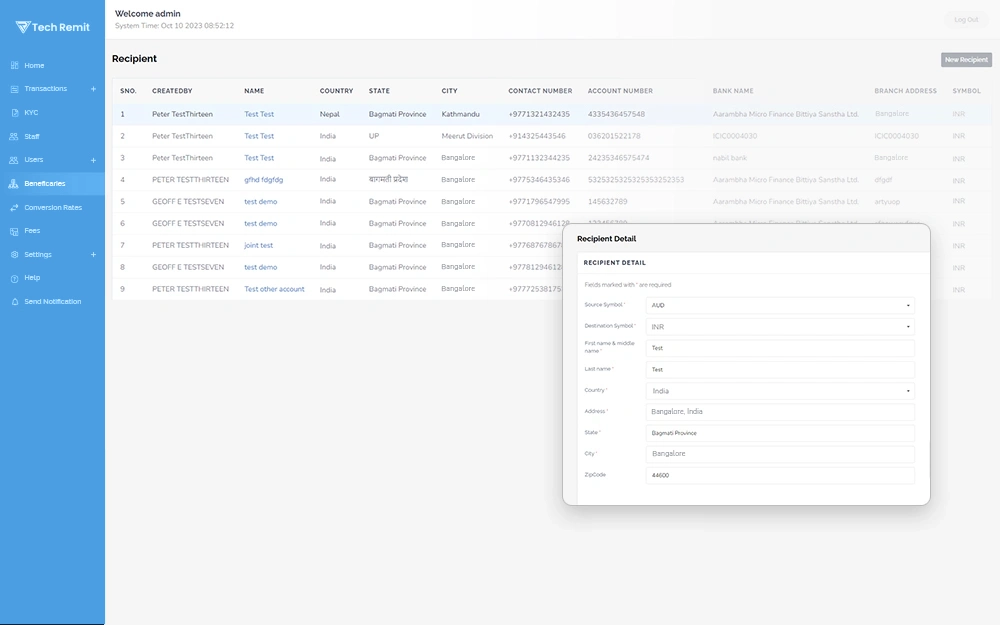

After this, the user needs to supply the recipient’s name, phone number, and bank account details for a successful transfer.

Finally, the funds transferred are securely delivered to the recipient following the necessary deductions, including exchange rates, transfer fees, or else.

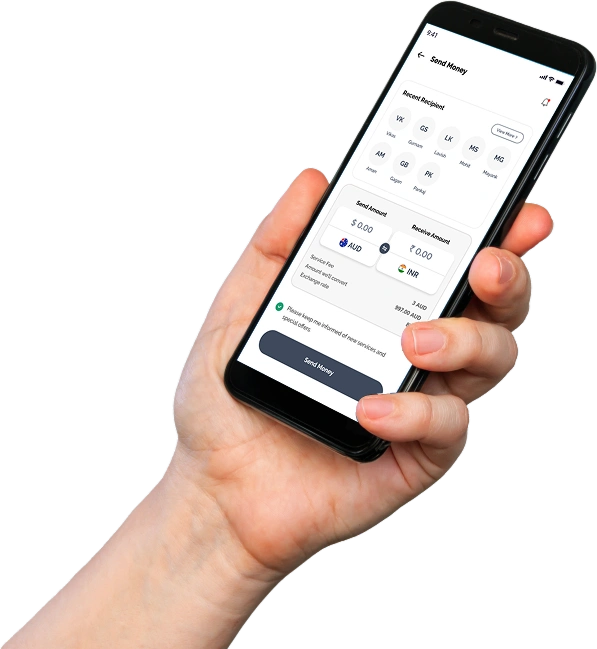

Provide your remitters with impressive accessibility to send money anytime, anywhere, using our feature-rich mobile application. While users enjoy unmatched convenience, you can expand your reach with the Prime Web Technologies remittance app.

Following a structured approach, we provide comprehensive consulting and development services to build a remittance solution that best suits your business needs:

Our consultants would engage and guide you through the integration of a remittance solution into your business operations.

We would gather your business insights and refine the product concept to ensure the delivered product aligns with business goals.

Following that, our team of experts would select the features required to design and develop robust money transfer software.

The cross-border payment software is rigorously tested before deploying it in the live market to spot and address potential issues on time.

Our experts integrate the remittance software into the existing systems by ensuring compliance with necessary regulations and meeting industry standards.

We monitor the delivered remittance software for the latest updates or any bugs to address the issues, ensuring the safety of business and customer data.

Here is the list of the latest technologies and tools to build advanced cross-border payment software for businesses:

Prime Web Technologies is the trusted money remittance software development company of several major remittance businesses in the UAE. We create enterprise-grade remittance solutions that are tried and tested to provide secure foreign exchange (FX) and cross-border money transfers.

Yes, our software supports multiple currencies and can carry out international transactions in almost any currency. Depending on the needs of your business, you can choose the currencies and provide remittance services for any country.

Our platform is designed to automate compliance with international regulatory standards, regardless of which countries your services operate in.

By incorporating advanced security features like multi-factor authentication, sophisticated encryption, and fraud detection systems, our remittance platform maintains the security of transactions.

Yes, you can customize your platform integration according to your business specifications. Our experts will assist you with various customization options.

We have partnered with leading payout networks, including Ripple, MoneyMatch, Currency Cloud, PaymentRails, Nium, Tranglo, Monoova, Hello Zai, Zepto, and several others.

Our platform has a dynamic exchange rate management system that adjusts exchange rates as per the market conditions. You can customize the transfer rate calculator for nearly any currency pair and configure the exchange rates as well.

Yes, it is. Our remittance software solutions not only assist new startups but also traditional banks in innovating their remittance services.

Yes, users can easily monitor the progress of their transfer through the transfer status feature. Our remittance application even provides real-time notifications to inform users instantly about the status of their money transfer.